After months of falling house prices, there was a rise of 0.9% in October which amounts to the highest increase in a year. For those planning to purchase a new home, however, the question remains as to whether it’s best to wait and see what happens with the market, or forge ahead and buy now.

Here, we’ll take a look at what’s happening with house prices, whether they’ll crash in 23/24, what will happen to mortgage rates, and if now is, in fact, really the best time to buy.

What’s Happening To House Prices and What Has Been Causing Them To Fall?

The good news is that house prices have climbed over the last year, but unfortunately, the combination of surging interest rates and the cost of living crisis have had an adverse effect on household budgets. This has resulted in the rate of property price growth falling and even stalling, meaning that, despite the 0.9% increase in October, prices are much lower than at the same time last year, which was 3.3%.

As buyers grapple with the hike in interest rates, Nationwide has said that overall housing market activity is ‘extremely weak’, although house prices remain well above pre-pandemic levels. And whilst the average cost of a UK home has increased by £43,785 (or 20.3%), Zoopla have said these price increases are on track to decrease by 5% over the whole of 2023.

Again, the cost of living crisis and rising interest rates have squeezed household budgets, in turn causing house prices to fall. Between the end of 2021 and mid 2023 the Bank of England raised the base rate a remarkable 14 times, from 0.1% to 5.2%, the highest level since April 2008. Monthly mortgage payments are, on average, 50% higher than in 2021, and rising rates mean it’s more expensive to borrow, so ultimately fewer potential buyers can afford to secure a mortgage.

House Prices in 2023/24: Is it Best to Buy or Wait?

The ongoing decline in house prices is expected to continue into 2024, due to much more expensive mortgages and reduced demand in the housing market. Homeowners are also much more likely to sell due to being unable to keep up with their mortgage payments. At the same time, inflation is rising, meaning goods and services are more expensive than last year, making it more difficult for people to be able to save enough to buy.

Many first-time buyers will be hoping that house prices fall further, making it more affordable for them to purchase their first home. As the Bank of England tackles soaring inflation, though, borrowing is expected to become more expensive, which inevitably means demand begins to dwindle.

As such, whilst this results in saving money on the purchase of a property, these reserves are likely to be erased due to higher mortgage rates. It’s also true that more and more sellers are becoming increasingly risk-averse as we face the threat of recession, and there’s data to support the fact that potential buyers are putting off going ahead due to financial concerns.

Of course, whether this is a good time to buy or not is dependent on your unique set of circumstances. Everyone should be aware, however, that mortgage rates have increased over the past year, so it is more expensive to borrow money to buy.

Similarly, house prices are expected to fall over the course of the next few years, so anyone buying now might see the value of their property decrease. Yet, as rents continue to rise, the appeal of homeownership remains, as ever, a hugely appealing prospect, regardless of what’s happening more widely.

Please get in touch with our Sales team we will be happy to assist you:

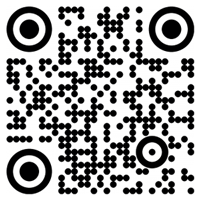

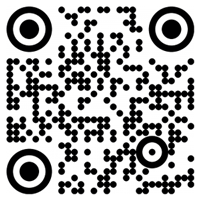

E: xiuxiu.sun@chbl.uk

Office Tel +44 (0) 207 903 6881

Contact form https://www.chbl.uk/en/contact

LinkedIn Crown Home Buying & Letting

Instagram @chbl.london

TikTok @chbl.london