Post-pandemic, house prices in the UK had been on a significant upward trajectory, steadily increasing in value until recent months when an increase in inflation and mortgage rates meant a sudden and almost unprecedented decline. As a result, some industry experts have predicted that as the market becomes more volatile a property crash is on the horizon, compounded by buyers pausing their plans for home-ownership as they wait for things to stabilise. Others, however, disagree that a crash is likely, arguing instead that a nominal fall of 10% was always expected.

Here, we’ll take a look at house price predictions for the next five years based on expert sources so as to provide some clarity going forwards.

The Current State of the Market

An intense surge in the market in 2020 has since slowed due to adverse economic conditions, with data from Nationwide showing that prices have fallen by 1.1% to their lowest level since 2012. Meanwhile, the beginning of this year saw a drop in house prices of 0.5%, part of a six month decline overall. Zoopla reports that sellers are reducing the asking price for their homes by an average of £14,100, reducing gains made during the pandemic by a third.

Predictions For the Next Five Years

Over the course of 2023/24 an increase in the base rate is expected, with Savills predicting an increase of 4% in early 2023 that will remain until mid-2024. Capital Economics have forecast something similar, estimating a rise of 5% in 2023, dropping to 4.5% by 2024. Experts agree that mortgage rates of around 5% will remain for the duration of the next two years. This means fewer buyers being able to afford a new home and house prices dropping, whilst sellers will be less willing to sell with prices having fallen by this much. Savills expect it won’t be until the end of 2024 when the market really starts to recover.

2025 to 2027

If mortgage lenders do as expected and reduce rates in the next year or so, falling inflation in 2024 will mean a drop in base rates. Savills predicts a house price increase of 7% by 2026. This indicates a crash in the market remains highly unlikely. By 2027, the Office of Budget Responsibility estimates an increase in house prices of 3.5%, with average growth of 1.7% between 2023 and 2027. As such, experts are cautiously optimistic about the state of the market going forwards, arguing that despite the difficulties of recent months, things are steadily returning to normal.

Sources: The HomeOwners Alliance, The Economist

Please get in touch with our Sales team if you are interested in buying, we will be happy to assist you:

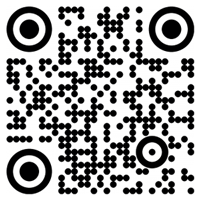

Properties for sale https://www.chbl.uk/en/buy-properties

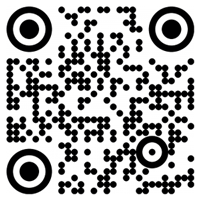

Contact form https://www.chbl.uk/en/contact

Office Tel +44 (0) 207 903 6881

E: xiuxiu.sun@chbl.uk