There’s little doubt 2022 was a tumultuous year for the UK property market, after finally moving on from the pandemic, the rise in interest rates and the far-reaching effects of the war in Ukraine. However, things look set to normalise again in 2023, with sales volumes already slowing and a turnaround expected in the second half of the year, plus a range of legislative reforms expected in the coming weeks.

What’s Changed Since 2022?

Early 2022 was characterised by high demand, limited supply and high prices, all of which impacted markets across the globe. As we usher in 2023, things have already adjusted, and despite house prices falling to some extent and other homes lingering on the market, the general consensus from industry experts is this is less of a correction but rather a return to normal. This is because sales activity and price growth were too excessive to continue at such levels, and, as such, were always expected to slow down sooner or later.

According to a report from Knight Frank, global house price growth for luxury properties has slowed, down from 10.9% at the beginning of 2022 to 8.8% now. What’s important to remember, though, is that when accounting for inflation this means house prices have only declined by 0.3%. There’s good news for the London market, too, as it remains extremely popular with buyers, and is the city where most high-net-worth individuals plan to buy over the next year or two.

Meanwhile, Central London is expected to do particularly well as international buyers take advantage of the weak pound. As ever, boroughs like Marylebone, Kensington and Chelsea and Mayfair are a big draw.

What’s expected in 2023?

Legislative Changes in 2023

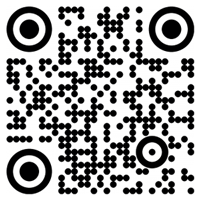

Registration Deadline for Those from Overseas Who Own a UK Property Over the course of 2023 we’re going to see a series of significant reforms to existing legislation. Firstly, The Economic Crime (Transparency and Enforcement) Act 2022 (ECTEA) requires anyone from overseas who has acquired a property in England since the 1st of January 1999 to register on the Register of Overseas Properties.

Meanwhile, anyone from overseas who has acquired a property in England before 1st August 2022 is required to register on the Register of Overseas Properties by 31st January 2023. To not do so is a criminal offence and will mean being unable to sell, lease or charge that property. Once registered, information must be updated annually.

Energy Efficiency

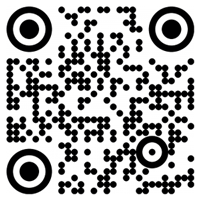

From the 1st April 2023, landlords will be unable to let a property with an EPC rating below E - which constitutes a ‘substandard’ property - unless they’ve implemented all possible energy improvement works and the property remains at the same substandard level. They are, however, able to register a permitted exemption on the PRS Exemptions Register. If not, any property which falls below an EPC E rating must comply with requirements in order to avoid a financial penalty.

Going forwards, as the UK seeks to reach net-zero emissions by the middle of the century, the government is expected to implement reforms that increase energy efficiency. This will mean landlords have to meet requirements and ensure the EPC rating of their property is raised from an E to a B. Landlords may also have to decide whether or not to include tenants in the improvement works, sharing the cost with them, depending on the terms of their lease.

The Building Safety Act

Passed in April 2022, The Building Safety Act (BSA) introduced a range of important changes to building safety for residential properties. The emphasis is on ‘higher risk’ buildings, specifically buildings that are over 18 metres or seven storeys high. Building owners, developers, contractors and occupiers will need to be aware of both the financial and operational effects of the BSA, which is to be implemented in stages.

Measures to tackle fire safety issues have already been implemented, however, other aspects of the act are still being finalised by the government and are expected to be announced between April and October 2023. These will include new management duties for the owners of high-risk buildings, plus new measures to monitor accountability and implement safety inspections.

There is also to be a Building Industry Scheme that will prohibit non-members from undertaking development work. Developers and contractors who carry out fire safety work on their buildings are eligible to join the scheme.

It’s also worth noting that, since 2022, there are statutory financial limits on leaseholders’ liability regarding costs that relate to building safety.

Renters Reform Bill

Expected in May 2023, the Renters Reform Bill is set to change the relationship between renters and landlords. It proposes introducing open-ended tenancies and an end to ‘no fault' evictions. It will also implement new and improved possession grounds, meaning landlords can continue to rent their properties with confidence.

It also means rent increases will only be permitted once a year, Decent Home Standards (DHS) will be applied to the private rental market, there will be extended Ombudsman powers, and fixed-term tenancies are to be scrapped.

Sources: mansionsglobal.com, the guardian, clydeco.com