HSBC has just called for a range of mortgage cuts, with other banks and building societies expected to do the same over the course of the next few weeks. The bank announced on Wednesday a fixed, five-year mortgage deal of 3.94% for anyone borrowing 60% of their property’s value. HSBC’s two-year fixed rate for remortgages is set to dip below 4.50%, with the headline rate reduced to 4.49% for those with a minimum of 40% equity in their property. For anyone seeking a longer-term solution, HSBC is introducing a 10-year fixed rate deal beginning at 3.99%, which experts say indicates the bank thinks rates are soon set to go down.

An HSBC spokesperson said, ‘Our new fixed mortgage rates will see significant cuts across the board which will be a welcome move. Specifically, for customers wishing to remortgage, our rates will start from 3.94% for a five-year deal at 60% LTV (loan-to-value) with a £999 fee.’ The result of this action has led to Lloyds Banking Group cutting its rates by the same amount. Meanwhile, Leeds Building Society has also stepped up, reducing its mortgage rates, in part because the Bank of England is expected to cut interest outgoings due to inflation coming down.

Many homeowners who’ve taken out new mortgages in 2023 have seen their monthly repayments double, but, again, interest rates coming down this year mean providers are due to significantly cut fixed rate offers. Indeed, the latest deals are the lowest since the rise in rates last summer. David Hollignworth, the director at L&C Mortgages said, ‘These cuts are just the latest salvo in an increasingly fast-moving market. Although borrowers coming to the end of their fixed rate this year will still be looking at a rise in payments, these new lower rates will at least take some of the sting out of the inevitable rise.’

However, leading economists have issued a stark warning, saying that mortgage owners coming off a fixed rate face a slowing economy and substantially higher overall costs. HSBC has said that, no matter what, its rates favour anyone looking to remortgage. Aaron Strutt, producer at Trinity Financial said, ‘The lenders will want to have the strongest possible start to the year. It seems likely that more banks and building societies will improve their rates over the coming weeks and fight it out to offer the cheapest deals.

As mortgages keep falling, they still remain at an all-time increase, and much higher than when many of us would have remortgaged. The good news, though, is that lenders who make up 90% of the market have signed up to the government’s mortgage charter. This support means borrowers will be able to get help, making changes to their mortgages, for instance switching to interest-only payments or extending their mortgage term, which means reducing monthly payments

For anyone that’s missed payments, they should know that they won’t be subject to any form of repossession for at least twelve months. For those facing difficulty, you’re entitled to support, whether or not your lender has signed up for the charter or not. Borrowers are able to change their mortgage and give themselves some space to relax and wind down

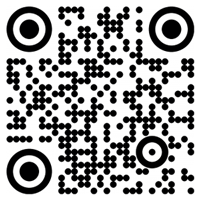

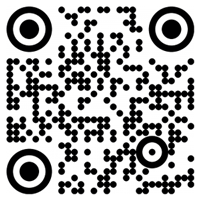

E: info@chbl.uk

Office Tel +44 (0) 207 903 6881

Contact form https://www.chbl.uk/en/contact

LinkedIn Crown Home Buying & Letting

Instagram @chbl.london

TikTok @chbl.london