Crown Home Buying & Letting is here to guide you on the two numbers you need if you are an overseas landlord: UTR (Unique Tax Reference) and NRL (Non-resident landlord).

Application process

Before officially becoming a landlord, you need to apply for two tax-related tax ID numbers at the same time, which are UTR and NRL.

UTR, also known simply as a "tax reference", is a 10-digit serial number that is required for filing taxes each year. After the application is approved, the UK tax office will mail this tax number in writing to the resident address you provided. You will need to take care of this document and provide it to your accountant when you file your taxes each year.

The reason why the NRL number is so important is that if you do not apply for it in time, the letting agent will not be able to receive the certificate letter directly from the UK tax office on time. Then, before the intermediary transfers the first rent to you, it must directly deduct 20% of your rent as a withholding tax according to British tax law and pay it to the tax bureau in time every quarter. The non-resident landlord is the registration number that landlords who live in the UK for less than 183 days per year need to apply for.

As a result, you will pay an extra portion of your withholding tax. Of course, you can apply for this part of the tax refund to the tax bureau through your accountant when you file your tax return at the end of the year, but it is time-consuming in comparison.

How do I avoid the 20% tax deducted by the agency first?

It's easy! Prepare ahead, and apply early.

The application period for overseas landlord registration number is about 4-6 weeks. Therefore, British Crown Real Estate recommends that you find an intermediary three months before you hand over the house so that you have enough time to apply in advance.

The specific fee depends on the situation. Usually, the intermediary charges separately for this part of the service; our staff helps our landlords apply for free.

Filling out the NRL mainly involves the following personal information: Personal name, long-term residential address, rental housing information in the UK and your intermediary information (NA number).

It is worth mentioning that only qualified intermediaries registered with the British Inland Revenue Department have an NA number and are eligible to prepay taxes for the Inland Revenue Department. Therefore, you must ask your agency for the NA number in advance.

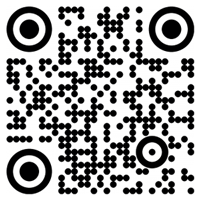

If you want to apply by yourself, you can refer to the video of How to Apply for NRL, from Crown Home Buying & Lettings, for a quick start to understanding the application process.

The landlord should also be reminded that if the intermediary deducted your tax in advance, you must ask the agency for a tax payment certificate (NRL6 certificate) on 5th July every year, and pass the information to your accountant for you to file your taxes accurately.

We hope this article is helpful to you. If you have a property in London and are looking for a reliable and professional agency to help you rent it out, please contact us. We are based in London where we provide you with buying, selling and letting management services.

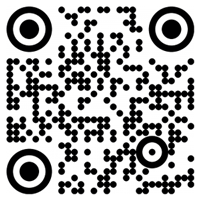

References: UK tax official website: https://www.gov.uk/find-utr-number