If you own a rental property in the UK and you’re not a UK tax resident (and also have no other income in the UK) then you’re required by law to declare and pay tax on any and all rental profits. You have until the 31st of January of the following year to complete your personal tax return. The UK tax year ends on 5th of April.

In other words, on January 31, 2023, you have to report rental income from April 6th, 2021 to 5th April 2022. For rental profits earned after April 6th, 2023 your reporting deadline is January 31st, 2024.

2.jpg)

1. How to File Your Taxes:

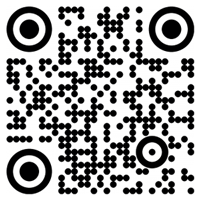

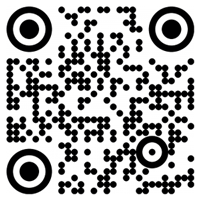

You can file your own taxes by using the link using this link www.gov.uk/log-in-file-self-assessment-tax-return or through a Chartered Accountant. Your real estate agent should be able to provide you with your properties’ earnings and expenses for the past year. Please remember, there are costs which can be claimed that your agent will likely be unaware of.

2. How Much Tax to Pay:

If you are a non-UK tax resident and have lived in the UK for less than 183 days a year, the tax amount is only related to your UK Property income and gains.

If you are a UK tax resident and live in the UK for more than 183 days a year, the amount of tax you pay is related to your worldwide income and gains, and not just those arising in the UK. This means your usual salary, dividends, investments and rental income from anywhere else in the world. Even if taxes in other jurisdictions are taxed together, it’s still possible to claim some relief if you are an overseas national living in the UK. However, that remains outside the scope of this note. So, from this perspective, high-income overseas buyers have a distinct advantage.

3. Is There a Tax Allowance for Overseas Buyers?

Depending on residence and nationality, some taxpayers will be entitled to receive part of their income tax-free. Every UK/EU national and every UK tax resident is entitled to this personal allowance. The personal allowance is not available for non-resident Chinese nationals. The personal allowance for the 2022/23 tax year is £12,570.

4. What is the Percentage of Tax Paid In the UK?

If you are a non-UK tax resident and there is no exemption limit, please refer to the tax limits below.

£0 - £37,700 is 20%.

£37,701 - £150,000 is 40%.

£150,000 is 45%.

If you are a UK Tax Resident and Have a Tax Exemption, Please Refer to the Tax Limits Below.

£0 - £12,500 is 0%

£12,500 - £50,270 20%

£50,271 - £150,000 40%

£150,000 is 45%

However, please note that if your taxable income exceeds £100,000 then you will lose your personal allowance as the rate is £1 for every £2 of income exceeding £100,000. This means your allowance is zero if your income is £125,140 or above.

5. Which Expenses are Tax Deductible?

Tax deductible expenses are agency fees, services charges, ground rent, home maintenance fees, and expenses incurred solely and exclusively for your property.

6. Is Loan Interest Tax Deductible?

For individuals, loan interest on residential property is not tax-deductible, but it is eligible for tax relief at 20%. This, in effect, caps the tax deductibility of loan interest. If the amount of the loan increases due to refinancing which results in an extraction of invested funds out of your property business, the additional interest from the increased loan is not tax deductible. It is important therefore to ensure you structure your affairs property before you buy a UK property.

7. How do I calculate my profit before tax?

Annual rental income - expenses related wholly and exclusively to running the business = income - loan interest * ER%= profit before tax

ER$ – effective tax rate

Please note that capital expenditure is usually tax deductible not against rent but against capital gains on disposal.